DIVISION BACKGROUND

MPIC Account Division was established on 1 October 2013 in line with requirement from Treasury Circular No. 4/2013- Implementation of the Federal Government Accrual Accounting and the transformation from Modified Cash Accounting to accrual accounting.

OBJECTIVES

- To assist top management in making decision to improve Ministry’s performance through optimal use of financial resources.

- To provide quality accounting and financing services, consultancy and advisory services and met customers’ expectation.

- To ensure the accuracy of the ministry's financial information and increase the integrity of the Federal Government Financial Statements.

- To reduce the risk of fraud and loss of public money

VISION / MISSION

- Leaders of excellence in public sector accounting and finance management that comply with Malaysian and International accounting standards.

MISSION

- Providing the best accounting and financial management services and strive to meet the requirements of our stakeholders and customers' needs.

ROLE & FUNCTION

Role

- Responsible as Accounting Office to the Ministry.

Function

- Manage payments for Operational, Development and Trust expenditure

- Reviewing and managing staff payroll payments

- Managing Receipts Account and review documents from Pejabat Pemungut

- Prepare Monthly and Annual Accounting Reports to stakeholders including top management, Accountant General Department and National Audit Department

- Provides training and advisory services on financing management and accounting

- Collect and analyse financial information to recommend efficient use of resources and procedures, and provide strategic recommendations.

ORGANISATIONAL CHART

Under Maintenance

KPI & ACHIEVEMENTS

1. Financial Statements

The Ministry's Financial Statements will be submitted or presented to the Controlling Officer every month. The preparation of the Financial Statement is mandatory starting from the first year of Accrual Accounting implementation in 2018. The Financial Statement consists of six (6) main components as follows:

2. Payment Management

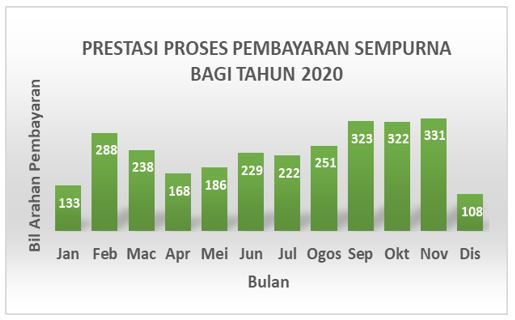

The KPI for the execution of the payment run to be performed in iGFMAS system is 2 days from the date of the voucher’s approval. For the period of January to December 2020, a total of 2799 vouchers were accepted for bank processing with the total amount of RM 551,514,282.60.

3. Payroll Management

With the iGFMAS System implementation, Payroll Module has been integrated in 2018 and can be keyed in by PTJ. The Accounts Division is responsible for payroll payment run according to the date set by the Accountant General's Department of Malaysia (AGD). For the year 2020, a total of RM20,357,480.86 payroll payments have been processed.

4. Data Collection and Opening Balance Data Migration

The data collection activity for the opening balance of assets and liabilities is an initial process for accrual accounting implementation. It involves the components in Statement of Financial Position. The data will be migrated as opening balance data for Immovable Assets, Movable Assets, Assets Under Construction, Accounts Receivable, and Accounts Payable.

Each data that conforms to the MPSAS interpretation will be collected by the Accounts Division and sent to the Ministry's Internal Audit Unit (UAD) for verification. Verified data are then submitted to the Accountant General's Department of Malaysia (AGD) for data migration. Accurate verified data will be signed (sign-off) by the Accounts Division officer in charge before it is being uploaded as opening balance data.

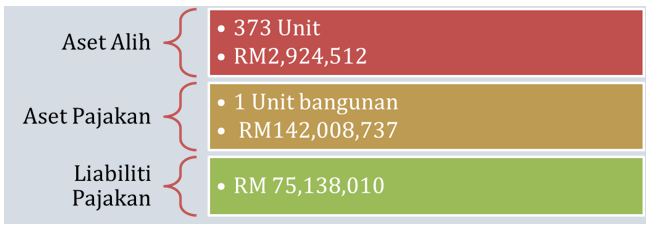

The following is a list of assets and liabilities that have been successfully uploaded as opening balance data in the Ministry's Statement of Financial Position up to 2020.

5. Inspectorate

a) Expenditure

Inspectorate are conducted on expenditure management with the aim of enhancing the accountability of financial management in order to achieve high performance in terms of internal control and compliance with regulations. This inspection visit was carried out on 15 to 28 July 2020.

Overall, based on the review of financial documents conducted and the risk assessment matrix [Risk Control Matrix (RCM)], the level of expenditure management in the Finance Unit, Development Management and Finance Division is EXCELLENT. This assessment covers aspects of compliance with circulars, procedures and financial instructions related to expenditure management during the period.

b) Asset

This inspectorate is carried out on asset management to ensure that each expense transaction complies with accrual accounting principles and financial regulations in force. In addition, it is to ensure that government movable assets are managed well and efficiently and comply with the current regulations in force, which include compliance with Treasury Circular (PP) AM2 - Government Movable Assets Management Procedures.

6. Organizing Training / Courses in Finance and Accounting

In line with the shift from a modified cash accounting basis to accrual basis, several courses, programs and activities were held throughout 2020 to provide exposure to all levels of MPIC officers.

7. User Access Management (Authorization)

User Access Management (Authorization) is intended to manage the creation of New User IDs and Role Settings (update / deletion). Access to user roles will be created or updated based on Power and Duty granted by Controlling Officers to Accounting Officers. This is inline with the National Accountant Circular No. 6 of 2018 issued by JANM. Two Administrators from the Accounts Division were appointed Local Admin to manage this activity. As at December 2020, 53 user requests have been processed.

8. Complaint and Inquiries Management Through iGFMAS Service Desk

Complaints and Inquiries Management for the iGFMAS system is made through iGFMAS Service Desk on the iGFMAS Portal and is a web-based application. Reported complaints are named as Incidents and incident number will be generated automatically as a complaint reference. From January to December 2020, 85 Incidents have been reported from End User (PTJ) and Accounting Office (AO). Of these, 33 Incidents have been extended to the JANM Headquarters for action while the rest has been resolved by the Accounts Division.

9. Implementation of Management Accounting

Management Accounting plays a role in collecting and analyzing financial information to recommend the effective use of resources and procedures and provide strategic recommendations.

The year 2020 is a benchmark for the implementation of management accounting. The Accountant General's Department of Malaysia has implemented a new initiative in public money management by introducing Strategic Management Accounting and Reporting (SMARt).

SMARt is a structured mechanism that comprehensively identifies, measures, analyzes, interprets and communicates financial and non -financial information to decision makers.

SMARt uses a bottom-up approach that covers every level of the Ministry covering Divisions, Departments and PTJs. The four main elements of SMARt are Financial Statement Analysis and Risk Assessment, Costing, Performance Measurement and Resource Analysis.

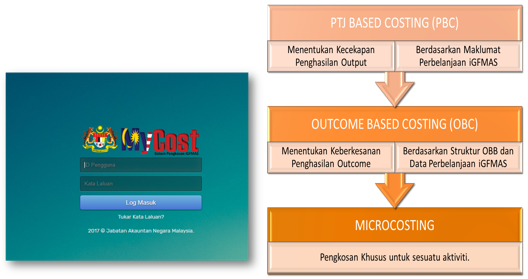

The implementation of the costing element requires each Ministry to use the MyCost system. In MyCost there is a PTJ Based Costing module for PTJ level costing, an Outcome Based Costing module for Ministry level costing. While Microcosting is a costing module for a specific project/activity.